The stock market is the greatest wealth-building machine in history. Yet, for many, it feels like an exclusive club where only the rich or the “finance bros” are invited. You might be thinking, “Don’t I need thousands of dollars to start?” or “What if the market crashes tomorrow?”

Here is the truth: You don’t need a lot of money, and you definitely don’t need a finance degree. In fact, with the rise of fractional shares and user-friendly apps, investing has never been more accessible.

If you are tired of letting inflation eat your savings and want to actually grow your wealth, you are in the right place. We are going to break down exactly how to invest in stocks, from opening your first account to buying your first share.

Building a strong financial foundation starts with reading the best investment books written by market experts. Whether you are looking for a classic investing book like The Intelligent Investor or modern stock market books, these resources provide timeless wisdom on risk management.

Many books about investing focus on the power of compounding and emotional discipline. If you want to refine your strategy, exploring the best investing books will help you understand market cycles. Ultimately, a well-chosen investing books collection is the most valuable asset for any serious investor.

Key Takeaways

- Time is your best asset: The earlier you start, the more compound interest works in your favor.

- Start small: You can begin with as little as $5 or $10 using fractional shares.

- Diversification is safety: Don’t put all your eggs in one basket; use Index Funds or ETFs to spread risk.

- Think long-term: The stock market is volatile in the short term but has historically returned an average of ~10% annually over the long run.

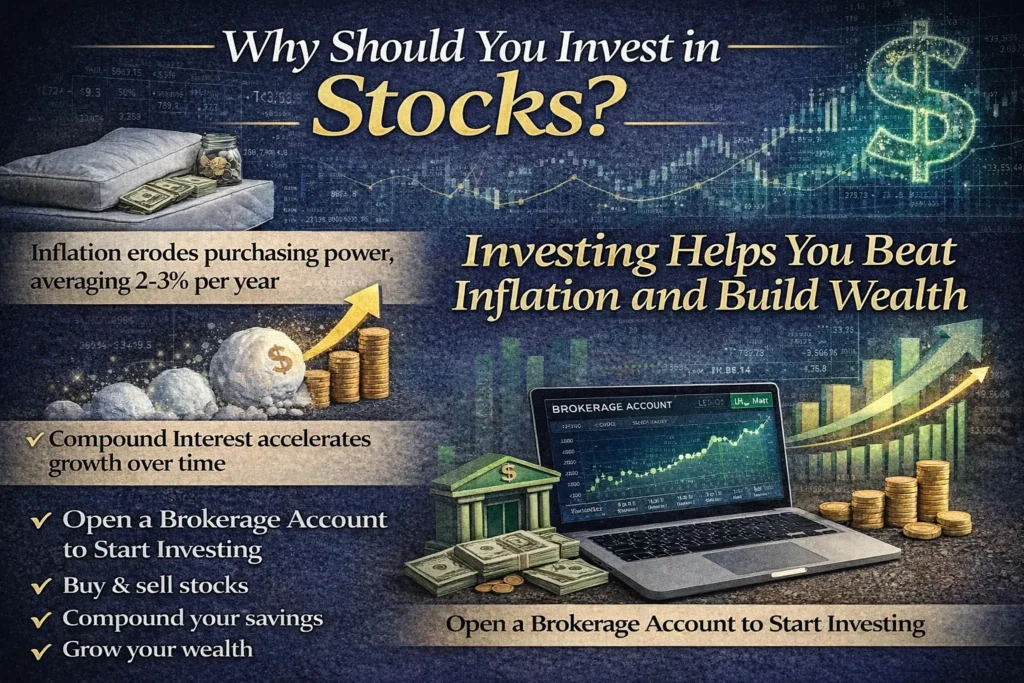

Why Should You Invest in Stocks?

Before we get into the “how,” let’s briefly talk about the “why.” Putting your money under a mattress (or in a standard low-interest checking account) guarantees one thing: you will lose purchasing power.

Inflation generally runs around 2-3% per year. If your money isn’t growing faster than that, you are technically losing money every day.

Investing allows you to tap into Compound Interest. This is when your interest earns interest. Over 10, 20, or 30 years, this snowball effect can turn small monthly contributions into hundreds of thousands of dollars.

Understanding the brokerage account meaning is the first step toward building personal wealth. At its core, a brokerage account definition refers to an investment account held at a licensed brokerage firm that allows you to buy and sell various securities. While often called a stock account, these brokerage accounts are versatile, allowing you to hold bonds, mutual funds, and ETFs alongside individual stocks.

If you are wondering what is a brokerage account exactly, think of it as a bridge between your bank and the financial markets. To start investing, you must open a brokerage account by choosing a firm that fits your needs. The process of how to open a brokerage account is now simpler than ever; most platforms allow you to open brokerage account online in minutes by providing your identification and linking a bank for funding.

Understanding what is brokerage account functionality—such as market orders and dividend reinvestment—is essential for any new investor. Once your brokerage account is funded, you have the power to grow your savings through the global economy.

Read Also: How to Tie a Tie

Step 1: Decide How You Want to Invest

Not all investors are the same. You need to pick a style that fits your personality and schedule.

Learning how to buy stocks has become incredibly accessible in the digital age. To buy shares, you first need to choose a platform where to buy stocks online, such as a reputable brokerage app. Once your account is funded, you can buy stocks online with just a few clicks.

If you’re wondering how to buy shares or how to buy stocks online, simply search for the company’s ticker symbol and place a “market” or “limit” order. Whether you want to buy stock for long-term growth or short-term gains, the ability to buy stocks from your phone makes investing easier than ever.

Cash App investing has revolutionized how people access the financial markets by making the process mobile and incredibly user-friendly. Through Cash App stocks, you can purchase fractional shares of your favorite companies for as little as $1, meaning you don’t need hundreds of dollars to own a piece of high-priced tech giants.

This platform is ideal for those who want a simplified experience without the complexity of traditional brokerages. Once you set up your account, managing your cash app stock portfolio is as easy as sending money to a friend. With features like “Auto-Invest” and “Round Ups,” Cash App investing helps you build wealth automatically by putting your spare change to work in the market.

The “Do-It-Yourself” Approach

This is for people who want control. You choose the specific stocks or funds you want to buy.

Stock market investing for beginners starts with building a solid foundation through learning to invest in stocks. If you want to learn stocks, focus on broad market ETFs rather than individual companies. Many people ask how to get into stocks; the easiest way is to learn to invest in stocks by opening a brokerage account and starting small.

The best stocks for beginners are usually well-established “blue-chip” companies or index funds that track the S&P 500. When investing in stocks for beginners, the key is consistency over timing. Understanding how to invest in stocks for beginners and practicing stock investing for beginners with a long-term mindset will help you navigate the market with confidence. Stocks for beginners don’t have to be complicated if you start with the basics.

- Pros: Lower fees, total control, potential to beat the market.

- Cons: Requires research, discipline, and emotional control.

The “Do-It-For-Me” Approach (Robo-Advisors)

Robo-advisors (like Betterment or Wealthfront) use algorithms to manage your portfolio based on your risk tolerance.

- Pros: Hands-off, automatic rebalancing, great for beginners.

- Cons: You pay a small management fee (usually 0.25%).

Step 2: Open an Investment Account

To buy stocks, you need a brokerage account. Think of this as a bank account specifically for your investments.

If you are investing for retirement, look into an IRA (Individual Retirement Account) or a 401(k) first, as they offer tax advantages. If you want easy access to your money at any time, open a standard taxable brokerage account.

Here is a quick comparison of popular brokerages for beginners in 2025:

| Brokerage | Best For | Min. Deposit | Fees (Stock/ETF) |

| Fidelity | Overall Best / Research | $0 | $0 |

| Robinhood | Mobile Experience / Ease of Use | $0 | $0 |

| Charles Schwab | Beginners & Support | $0 | $0 |

| Vanguard | Long-term Index Fund Investors | $0 | $0 |

Step 3: Choose Your Investments

This is where most people get stuck. Do you buy Apple? Tesla? Or something else entirely?

Learning how to invest in stocks for beginners with little money has never been easier thanks to modern financial tools like fractional shares and zero-commission apps. Even with just $5 or $10, you can start building a portfolio by purchasing small “slices” of expensive companies that were previously out of reach. For those looking for the best stocks for beginners with little money, low-cost Exchange-Traded Funds (ETFs) or index funds are ideal because they provide instant diversification across hundreds of companies for a very low price.

The key to success is consistency; by setting up small, automated deposits, you can grow your wealth over time through compounding. Many platforms now have no account minimums, allowing you to invest in stocks for beginners with little money without needing a large lump sum. Start small, stay patient, and focus on broad market growth to turn even a tiny budget into a significant long-term investment.

1. Individual Stocks

This means buying a share of a specific company (e.g., buying one share of Microsoft).

- Risk: High. If that one company fails, you lose money.

- Reward: High. If the company skyrockets, you win big.

2. Index Funds and ETFs (Exchange Traded Funds)

Instead of trying to pick the “needle” in the haystack, buy the whole haystack.

An Index Fund (like the S&P 500) bundles 500 of the largest US companies into a single investment.

- Risk: Lower. You are diversified across hundreds of companies.

- Reward: Stable. You get the average market return (historically ~10%).

Pro Tip: For most beginners, a low-cost S&P 500 ETF (like VOO or SPY) is the safest and most effective way to start building wealth.

To understand how to make money in the stock market, you primarily rely on two methods: capital appreciation and dividends. When you learn how to invest in stocks and make money, you focus on buying shares at a low price and selling them higher. If you’re wondering how do you make money in the stock market consistently, it often involves long-term growth.

Additionally, you can how to earn money from stock market assets by collecting dividends, which are regular payments made by companies to their shareholders. Mastering how to make money in stocks or how to make money stocks requires patience, research, and a clear strategy.

Step 4: Set a Budget (and Stick to It)

You don’t need thousands of dollars to start. Many brokerages now offer fractional shares, meaning if a stock costs $200 but you only have $20, you can buy 10% of that share.

The secret is Dollar-Cost Averaging (DCA).

This implies investing a fixed amount of money at regular intervals (e.g., $100 every month), regardless of the share price.

- When prices are high, your $100 buys fewer shares.

- When prices are low, your $100 buys more shares.

- Over time, this averages out your cost and removes the stress of trying to “time the market.”

Investing as a teenager is one of the smartest financial moves you can make because you have the most valuable asset of all: time. While you generally cannot invest as a teenager on your own until age 18, you can start through a custodial account (like a UGMA or UTMA) managed by a parent or guardian. This allows you to build a portfolio of stocks or ETFs while you are still young.

Focusing on investing for teens means learning about the “power of compounding”—where your earnings earn their own earnings over decades. To get started, many people recommend looking at companies you already know, such as tech or gaming brands. By starting your journey now, you can turn a small summer job or allowance into a significant head start on your future financial freedom.

Step 5: Manage Your Portfolio (By Doing Nothing)

The hardest part of investing is often emotional control.

When the market drops (and it will), your instinct will be to sell to “stop the bleeding.” Do not do this.

Investing is a marathon, not a sprint. If you own a diversified portfolio, history shows the market will eventually recover and reach new highs. Checking your account every day will only stress you out.

- Review annually: Check once a year to make sure your asset allocation is still on track.

- Rebalance: If one sector has grown too large, sell a little off and buy the underperformers to stay balanced.

Learning how to invest in the stock market is one of the most effective ways to build long-term wealth. To start a stock investment, you must first decide where to invest in stocks, typically through a brokerage account. If you are wondering how to invest in stocks or how to invest in stock market indices, diversification is key to managing risk.

Many people begin by investing in stocks via low-cost index funds. Whether you choose to invest trading actively or prefer a passive strategy, understanding how to invest stocks allows you to grow your capital over time. Mastering stocks how to invest wisely will help you reach your financial goals faster.

Conclusion

Investing in stocks doesn’t have to be scary or complicated. By opening a brokerage account, choosing low-cost index funds, and consistently investing small amounts over time, you can build significant wealth.

The most important step is simply starting. The market rewards patience and time, so don’t wait for the “perfect” moment. The best time to plant a tree was 20 years ago; the second best time is today.

Ready to start? Pick one of the brokerages listed above, deposit $50, and buy your first fractional share of an S&P 500 ETF this week.

Frequently Asked Questions (FAQ)

Q: How much money do I need to start investing?

A: practically zero. With platforms like Fidelity, Schwab, or Robinhood, you can start with as little as $1 thanks to fractional shares. The barrier to entry has never been lower.

Q: Can I lose all my money in stocks?

A: If you invest in a single company and it goes bankrupt, yes. However, if you invest in a diversified Index Fund (which holds hundreds of companies), the entire US economy would have to collapse for you to lose everything. While the market fluctuates, it has historically trended up over time.

Q: What is the difference between a stock and an ETF?

A: A stock represents ownership in one single company (like Apple). An ETF (Exchange Traded Fund) is a basket of securities that includes many stocks (like Apple, Microsoft, Amazon, etc.) bundled together. ETFs offer instant diversification.

Q: Do I have to pay taxes on my stocks?

A: generally, yes, but only when you sell them for a profit (Capital Gains Tax). If you invest through a retirement account like a Roth IRA, your money can grow tax-free.